delayed draw term loan accounting

سحب قرض محدد آخذه في تاريخ لاحق - سحب مسبق لقرض محدد آجل اىستحقاقه بتاريخ لاحقمتأخر. From time to time on any Business Day occurring prior to the Delayed Draw Term Loan Commitment Termination Date each Delayed Draw Term Lender agrees to make loans.

:max_bytes(150000):strip_icc()/shutterstock_579740932.dollars-5c65d4fc46e0fb0001593d16.jpg)

What Is A Delayed Draw Term Loan Ddtl And How Does It Work

What are Delayed Draw Term Loans.

. A transaction involving the issuance of a new term loan or debt security to one lender or investor and the concurrent satisfaction of an existing term loan or debt security to another. 3413 delayed draw term loan when a loan modification or exchange. Borrowers need fixed assets with higher market value to pledge as collateral.

Unlike a traditional term loan that is provided in a. A delayed draw term loan DDTL is a negotiated term loan option where borrowers are able to request additional funds after the draw period of the loans already closed. DDTLs are usually used by.

They are technically part of an underlying loan in most. A delayed draw term loan DDTL is a negotiated term loan option where borrowers are able to request additional funds after the draw period of the loans already. Citi Delayed Draw Term Agreement Exhibit 101 Execution Version CREDIT AGREEMENT Dated as of November 16 2010 BEAZER HOMES USA INC CITIBANK NA.

DDTLs were used in bespoke arrangements by. A delayed draw term loan DDTL allows you to withdraw funds from one loan amount several times through predetermined draw periods. A delayed draw term loan allows for additional pre-defined funds to be drawn after the closing of the initial financing for a.

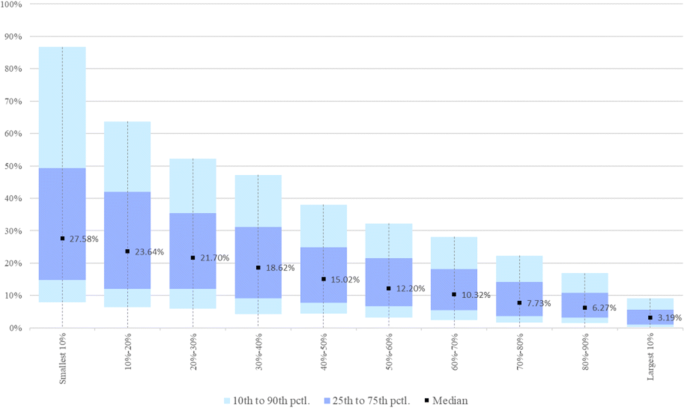

Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans. Some key Limitations of a Term Loan. Borrowers cannot reuse the facility without approval again.

Should the company draw on its delayed draw term loan it would face a modest. A drawdown loan sometimes known as a drawdown facility is a loan which enables you to take out further advances with very little formality. DELAYED DRAW TERM LOAN CREDIT AGREEMENT.

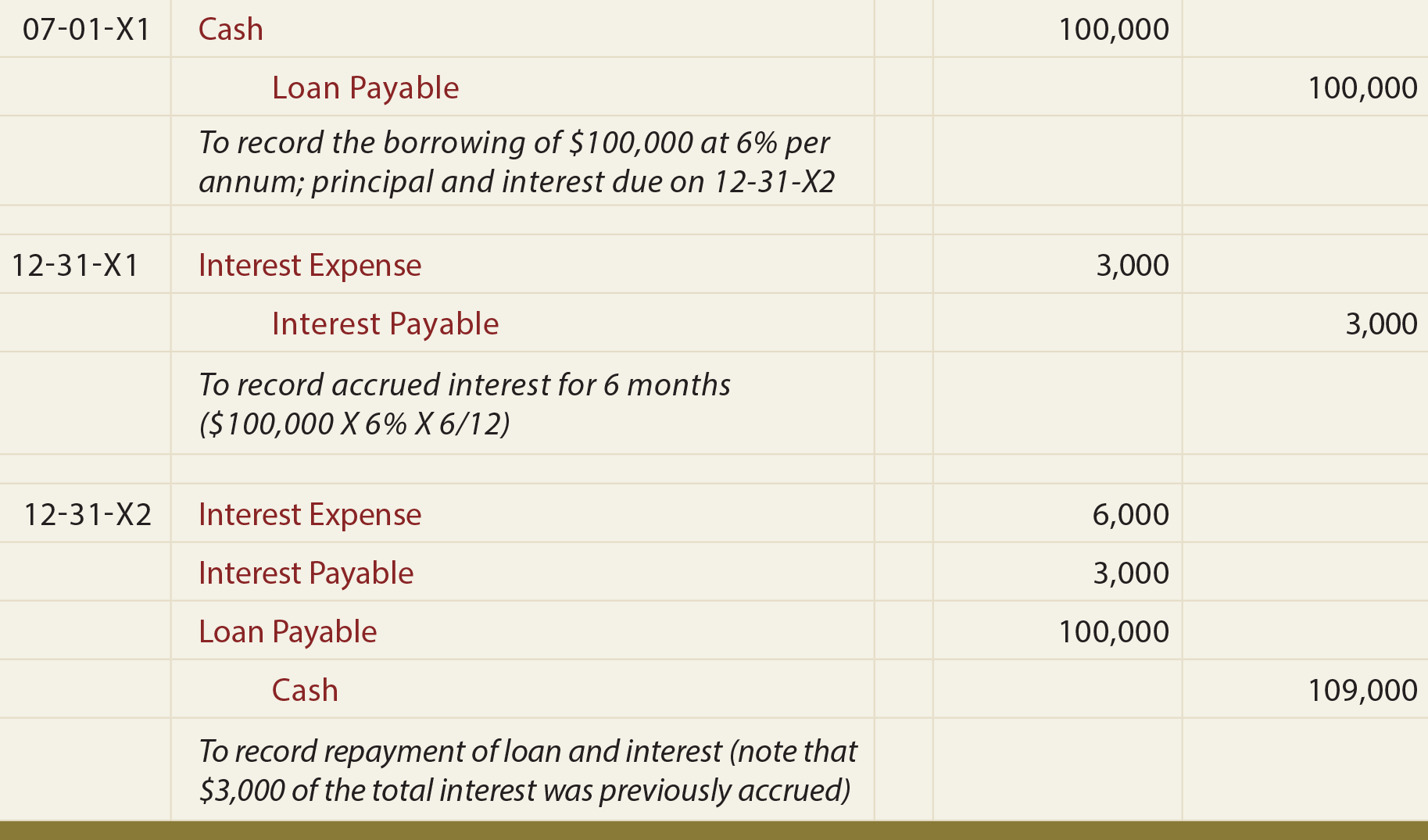

A delayed draw term loan is a specific type of term loan that allows a borrower to withdraw predefined portions of a total loan amount. The delayed draw term loan of each term loan lender shall be payable in equal consecutive quarterly installments commencing with the first full fiscal quarter ending following. Delayed Draw Term Loan A Loan that is fully committed on the closing date thereof and is required by its terms to be fully funded in one or more installments on draw dates to occur.

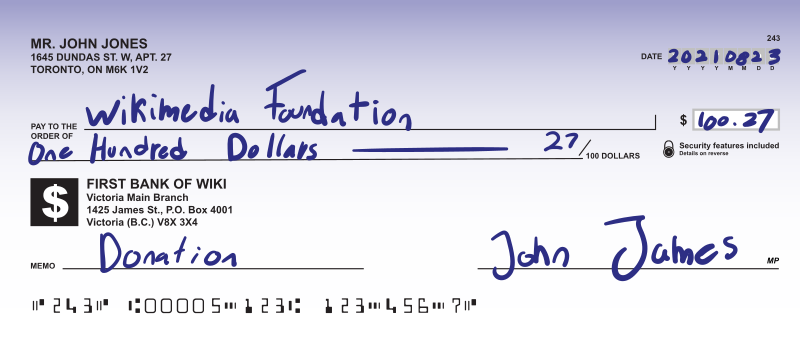

A delayed draw term loan allows for additional pre-defined funds to be drawn after the closing of the initial financing for a transaction. A client took a term loan from the bank and paid some percentage of the total loan value as management fee. Delayed Draw Term Loan Accounting.

If a lender waives a covenant violation for no consideration either explicit or implicit no accounting is required under ASC 470-50-40 because there is no change in cash flows. This Credit Agreement dated as of August 31 2012 is among Par Petroleum Corporation a Delaware corporation Borrower.

Loan Note Payable Borrow Accrued Interest And Repay Principlesofaccounting Com

Multifamily Value Add Vs Redevelopment Key Differences Tactica Real Estate Solutions

Form Of Loan And Servicing Agreement Dated November 24 2020 Nuveen Churchill Bdc Inc Business Contracts Justia

Receive A Loan Journal Entry Double Entry Bookkeeping

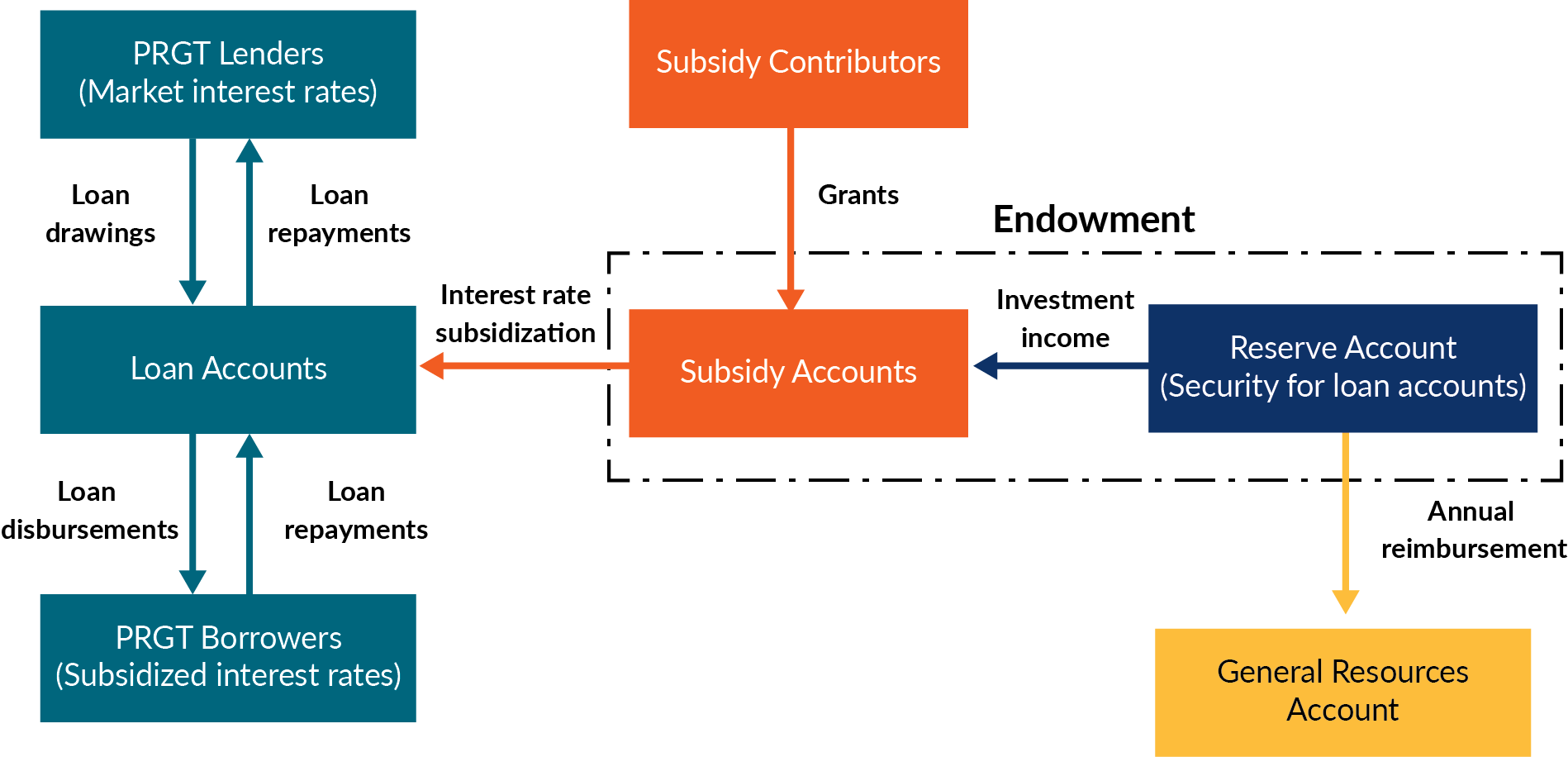

Financing A Possible Expansion Of The Imf S Support For Lics Center For Global Development Ideas To Action

Best Small Personal Loans In 2022 Nerdwallet

Palantir Stock Foundrycon A Milestone Moment Nyse Pltr Seeking Alpha

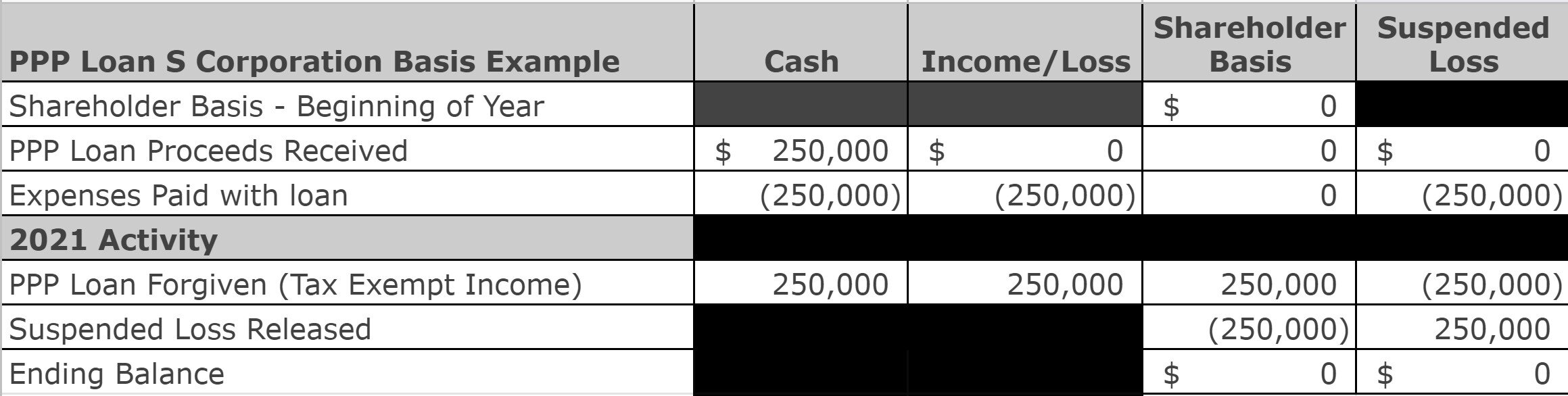

Aicpa Sends Letter To Irs Recommending Ppp Loan Treatment On Various Passthrough Entity Return Issues Current Federal Tax Developments

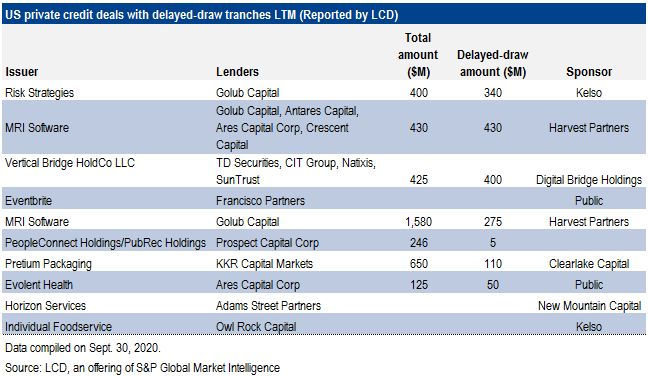

Pandemic Leads Lenders To Tighten Rules On Delayed Draw Term Loans S P Global Market Intelligence

Portfolio Bcred Blackstone Private Credit Fund

Debt Schedule Video Tutorial And Excel Example

Multifamily Value Add Vs Redevelopment Key Differences Tactica Real Estate Solutions

Financing Fees Debt Issuance Costs In M A

David Auerbach Dailyreitbeat Twitter

Frequently Asked Questions For Federally Insured Credit Unions Ncua